Jack Ma Return Signals Shift in China

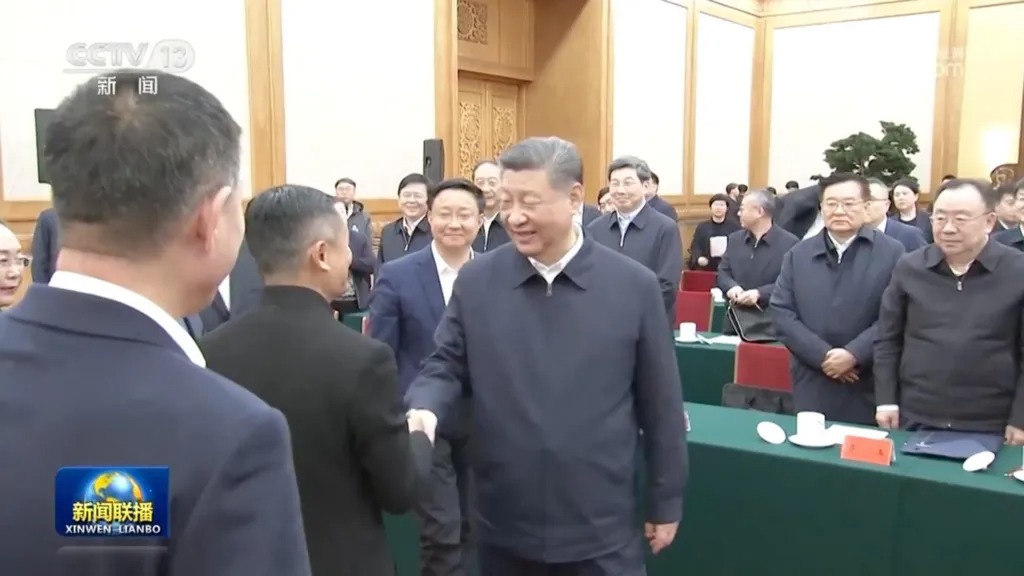

Jack Ma’s return to the spotlight at a rare meeting with President Xi Jinping on February 17, 2025, has ignited buzz across China. The Alibaba founder, absent from public life since criticizing financial regulators in 2020, joined tech titans like DeepSeek’s Liang Wenfeng at Beijing’s Great Hall of the People. His presence—shaking Xi’s hand, seated upfront—hints at rehabilitation after years of regulatory crackdowns. Tech stocks soared, with Alibaba’s shares jumping over 8% in New York on February 20 after beating earnings forecasts, up 60% this year. What does this Jack Ma return mean for him, China’s tech sector, and its economy?

Once China’s tech poster boy, Ma built Alibaba from his apartment into a global giant. His 2020 “pawn-shop” jab at state banks halted Ant Group’s $34.5 billion IPO, marking his fall. Now, analysts like Bill Bishop see his front-row seat as a sign Beijing’s forgiving past defiance—though his silence at the event and muted state media coverage suggest a partial comeback. Social media cheered, with Weibo users calling it a “safe landing” and “shot in the arm” for a sluggish economy.

H3: Jack Ma Return and Tech Crackdown’s End?

Xi told attendees to innovate and seize opportunities despite “temporary” economic woes, signaling support for private firms. The Jack Ma return aligns with this shift. Post-2020, China’s “common prosperity” campaign tightened data and competition rules, slashing tech valuations by billions and spooking investors. Education and real estate felt the squeeze too, aiming to curb billionaires’ sway. Now, with growth faltering—youth jobs scarce, property in crisis—Xi seems to pivot. Richard Windsor of Counterpoint says Ma’s presence suggests leaders want the private sector unleashed again.

Guests like Huawei’s Ren Zhengfei and BYD’s Wang Chuanfu underscore tech’s role in Xi’s vision. Lei Jun of Xiaomi praised the president’s “care” for businesses. Citi analysts noted the lineup reflects innovation’s priority—AI, EVs, and internet firms driving growth. DeepSeek’s R1 AI chatbot, a global hit despite U.S. chip bans, fueled this optimism, boosting Chinese stocks. For more, visit BBC or Kenkou Land.

Main Body: U.S. Rivalry Fuels Change

The Jack Ma return coincides with U.S.-China tensions. Trump’s tariff threats loom as DeepSeek’s AI success—a “Sputnik moment”—shows China can innovate under sanctions. Goldman Sachs predicts $200 billion in tech investment, with Hong Kong and mainland markets buzzing. Xi’s “high-quality development” and “new productive forces” push semiconductors, clean energy, and AI over old drivers like property. By 2035, he aims for a self-reliant, modern economy—needing private firms like Alibaba.

Yet, it’s no free-for-all. Marina Zhang of University of Technology Sydney sees “controlled engagement,” not an end to scrutiny. Ma’s muted role hints at boundaries—private success must serve state goals. His 2020 clash humbled a titan; now, he’s back, but aligned. Alibaba’s 8% stock surge on February 20 reflects hope, but lasting gains depend on policy shifts. Xi’s meeting, held February 17, 2025, offers a lifeline to a battered sector—growth, jobs, and tech rivalry hang in the balance.